New Brunswick

New Brunswick Economic Forecasts

[ Annual average % change, unless otherwise noted ]

| Economic Indicators | 2024F | 2025F | 2026F |

| Real GDP | 1.4 | 1.4 | 1.3 |

| Nominal GDP | 3.7 | 3.4 | 3.4 |

| Employment | 3.0 | 1.0 | -0.1 |

| Unemployment Rate (%) | 7.0 | 6.8 | 7.3 |

| Housing Starts (000’s) | 6.2 | 5.8 | 3.7 |

| Existing Home Prices | 10.4 | 7.6 | 3.2 |

| Home Sales | 3.1 | 8.8 | 4.3 |

New Brunswick’s (N.B.) economic outlook is a mixed bag. On one hand, the household sector is showing surprising resilience. A combination of low debt levels, still-rapid population growth, and robust labour demand is likely to continue to propel overall consumer spending in the near term. On the other, N.B.’s heavily export-dependent economy faces disproportional downside risks at a time where global trade tensions are on the rise. All told, we see economic growth humming along at around the national-average pace for the next couple of years.

A key risk facing N.B.’s economy is its dependence on the U.S. as a trading partner. The threat of a U.S.-imposed 25% tariff on all Canadian exports would likely hit the province’s top line GDP hardest. Chart 1 makes this point clear: across provinces, N.B. sends the highest proportion of its finished goods to the U.S. (90%) and has the second-highest exports relative to GDP (61%). Our baseline forecast does not include Trump’s full-scale tariff plan, but considers the hit to business investment via the sentiment channel.

For now, key goods sectors appear to be turning a corner. After seven consecutive quarterly contractions, N.B.’s manufacturing sector is on track register a healthy gain to cap off 2024. Further, building construction investment, both residential and non-residential, has gradually picked up momentum, providing a strong handoff into 2025.

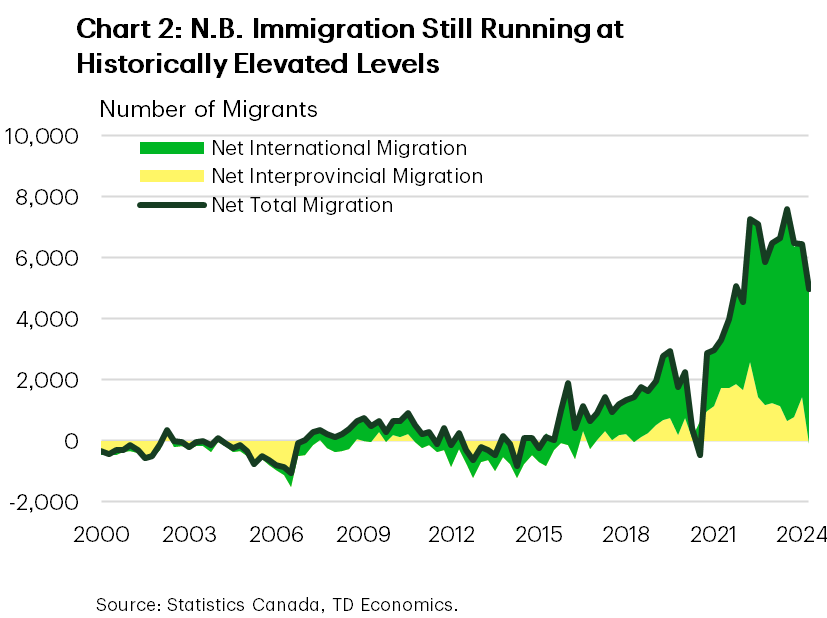

Unlike the rest of the Atlantic region, population growth in N.B. is still running close to peak growth rates, supported by elevated flows international migrants (Chart 2). We do expect the rate of in-migration to moderate on the back of new federal immigration policies, but not to the same extent as most other provinces.

In its mid-year fiscal update, N.B.’s government projected a slight deficit (-0.2% of GDP), which would end a run of eight straight years in black ink. Despite this modest deterioration, N.B.’s fiscal situation continues to remain solid compared to its peers. The government carries the fourth lowest net-debt burden among the provinces, pointing to some fiscal wiggle room to offset growth headwinds if needed.

Longer-term, N.B. is looking to cement itself as a national leader in green energy transition initiatives. Recently-announced funding from the Canada Infrastructure Bank (CIB) of up to $1 billion for Indigenous-led wind projects will continue to support investment and jobs in N.B.’s energy and resource sectors over the medium-term.

Leave a Reply